Weekly [05/26] Study

The previous release maintained a Bullish outlook expecting two-way trade but never a committed bear bias. A precise warning for tricky price action.

This allowed my positioning to aim [Close to ES 6000] but never all time highs.

This allowed me to expect Sellers to chime in, but never gain control of the auction.

Buying Dips outweighed Reward to Selling Rips 4:1. GG.

Here is the Market Generated Information since prior release.

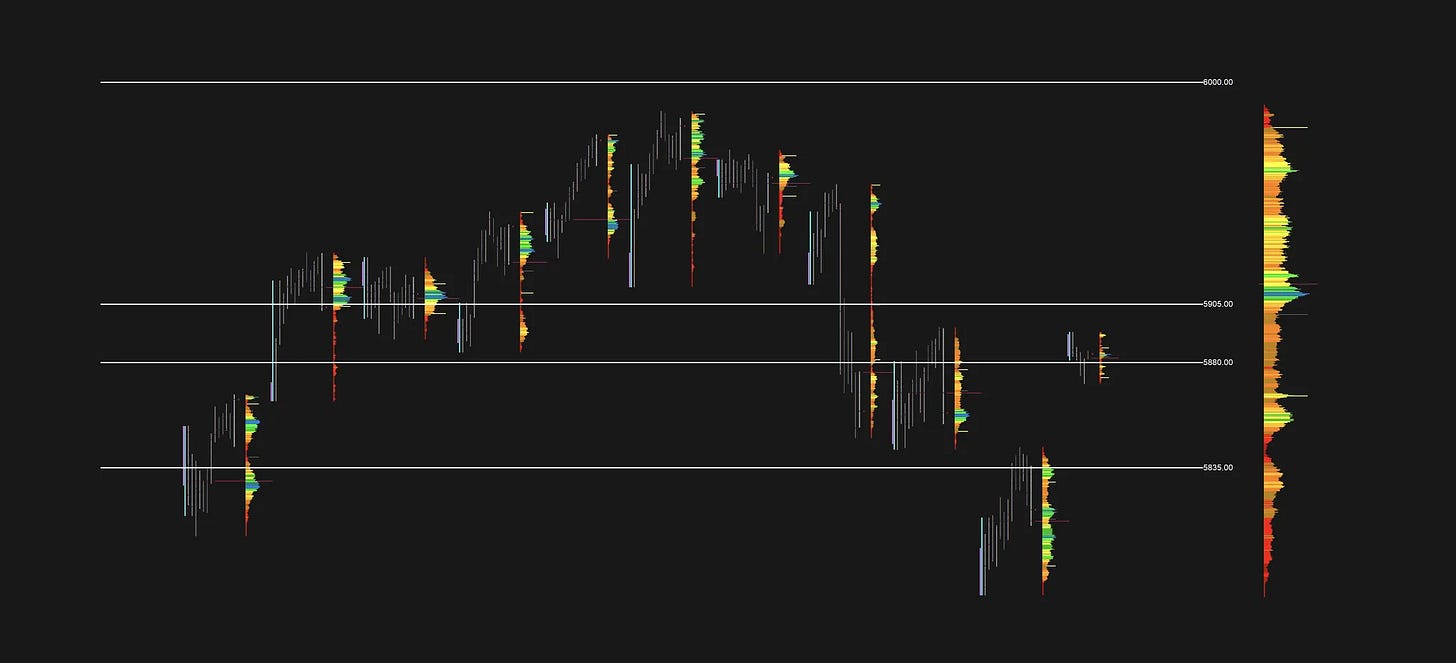

This is a TPO Chart of what actually happened, overlayed with my plan.

Context : 5665 : Long Entry : GAPPED UP; leading to the following :

5835 : Pivot : Dips were confidently Bought

5905 : Long Target : Achieved with Support and further Buying.

5980 : Two-Way Trade : Met by further Buying above 5905.

[ Close to 6000 : in plain text ]

If Buying persists, I simply do not want to assume anything is ‘too high’;

Sellers will have a higher chance of success below 5550;

— Traded another +400p higher above all old ‘top’ calls…

I’ve been inspired to Buy High and Sell Higher for the last few releases. My confidence however may not be matched with the readers of SetStack despite my many warnings. I tend to drop gems like these when I can.

With the lens of Hindsight, I would say I’m satisfied buying dips and maintaining my Long Bias than trying to Short a never-ending Top (going for weeks now).

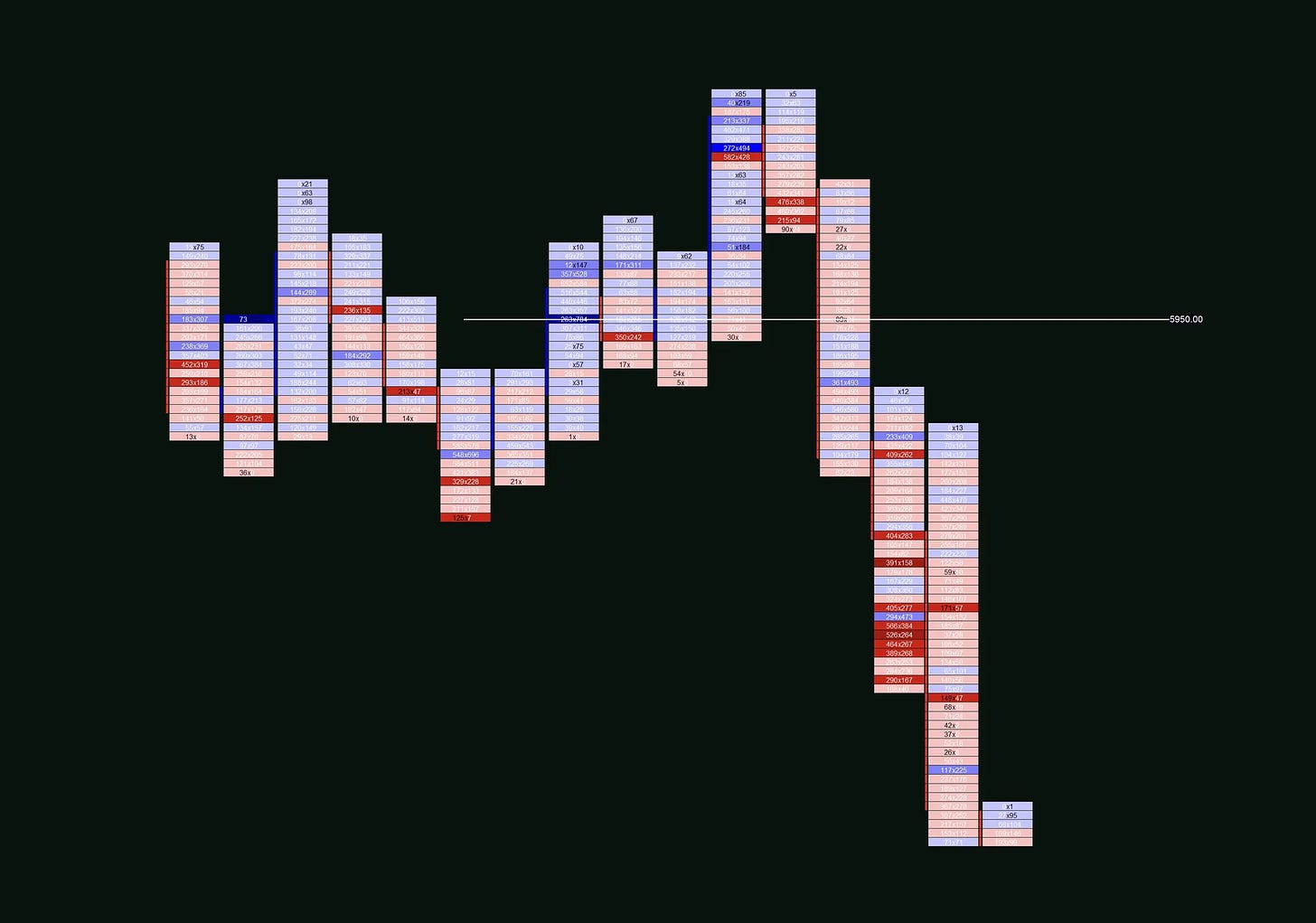

Rolling up the sleeves, we’ve finally met an outstanding Seller;

Hiding their intentions within the negative 20y Bond Auction,

They managed to form a local top along with a SetStack Offer.

Personally I identified this activity at 5950 with ease. My system however would not support the idea of flipping Short despite the intraday activity.

This simply was not the auction to get too fancy, particularly with retail Emotions running high and traders wanting to Short. A single mis-step in my words may give my readers ‘too much confidence’, despite my (very correct) navigation long at 5050.

I would rather be long, long, and long with trend.

Get banged up once or twice, and then consider reversing.

I can confidently grade this as a Textbook Rejection, but I’ll save the details for SetU.

Buyers accomplish an extending move since Open.

Shallow dips are actively being Absorbed and bought into.

Highs of Day being extended, but turning exhaustive.

Heightened activity into extremes without reward.

Headline release + Flush.

When Bullish activity turns Bearish.

(Strictly Educational of course), Selling into this pressure would offer good stats within this auction, the problem being; how many times prior has one sold into similar activity only to get trampled. Understand your Auction.

I can confidently grade this as a Textbook Reoffer, but I’ll save the details for SetU.

Sellers accomplish a Local Top

Heightened activity into extremes with reward.

SetStack Long Target acting as Resistance

Flush + Reoffer

When Selling begets further selling.

(Again, strictly educational), Selling into this would be the FIRST time my System approves flipping. This offer maintains strength into my Pivot 5835 but only in ETH.

My final farewell to X : +100p for a TP1 : 12,000 Views

Tariff headlines drop the Market below our Pivot early in the Morning.

Selling the break of 5835 prior ‘could have’ been a good move but pre market positioning is not a strong suit of mine.

Orderflow into my entry was again, quite clear and at the very least, with Trend.

I sided (in real time + ahead of time) Bulls again into my Entry.

This would be the Extreme case of Two-Way Trade and proven in RTH with failure to gain traction any lower. Caveat : Referencing prior level of 5750 : I play with Strength.

In similar fashion to my Longs at 5040, I expected Strong Sellers taking profits and passing the torch back to a proper Buyer. This handoff was quick and only accelerating into RTH hours.

A local low was sniffed allowing myself to gain confidence for 0de SPX.

Matched only by an incredible top trim into SetStack Pivot 5835.

Swings now proving correct with +100p mfe.

About these releases.

I deliver precise levels with even more accurate context ahead of time.

My thoughts and my Pivots stand the test of time, time and time again.

This is the natural progression of Understanding Auctions.

Only prompting a new update when Strong Tape is present.

SetStack is the first step in learning this knowledge.

SetU is the only step to in growing it further.

![Weekly [05/13] Study](https://substackcdn.com/image/fetch/$s_!PeMY!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F3bd4b60a-92a4-4b8c-a0a4-71dec676add0_2048x1168.png)