Weekly [10/25] Special

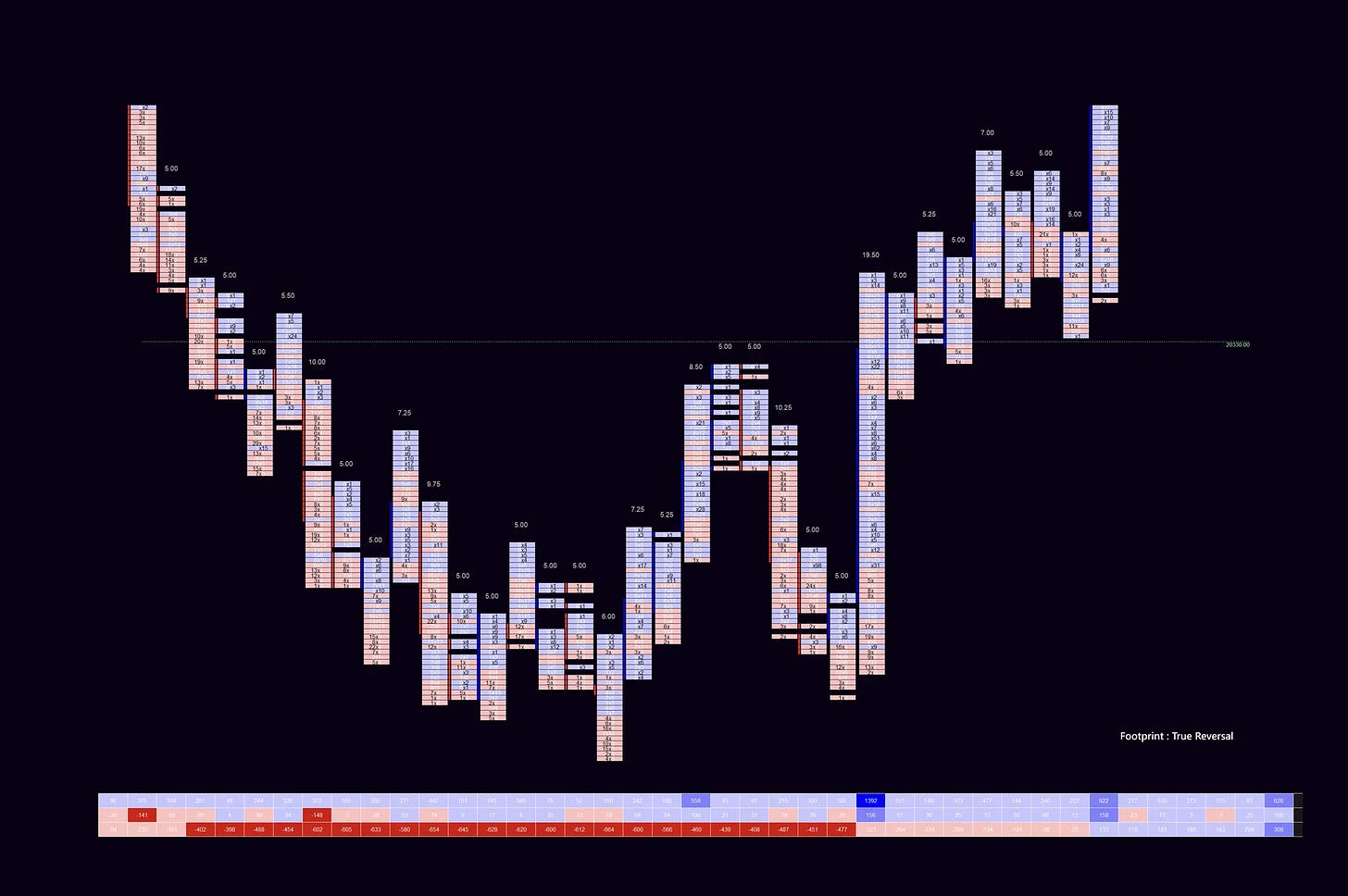

I’m going to Open this conversation with a snippet of a Chart from todays’ session. This is a 5minute Candlestick Chart for the Initial (10/24) Balance.

On the surface, it appears muted and rotational. This typically leads to a slow day or balanced, but the activity seen on the tape may be suggesting there’s something else in the making.

Context : Continuation of the Initiative Buying

Prior Session met a Buyer and RTH Open failed to retrace.

As I mentioned earlier, the Candlesticks left behind a muted session. I thought this was a trap. Beneath the surface, we have a ton of activity that may suggest Higher Prices coming.

The First Clue is the continued respect of $NQ : 20330.

As the market dipped into this area, a ton of Seller Activity was hitting the book, but failing to produce lower Prices. This is aligning with the prior days’ Volume Profile forming the lower end of a distribution. This combined with absorption on the Bid was the confluence I was searching for.

Higher.

Reminder : Footprint Charts prints Market Orders.

Sweeps of this calibre are not signs of Balance Days.

This is why I can always trust the tape.

As a result, $NQ : 20300 - 20330 Proves to be Support all Morning, but only managing to rotate. Following the continuing Narrative, this should be seen as a Buyer Filling at a Price, and as Price drifts away from their entry, It falls back into Balance as they are not yet ready to Initiate (possibly still filling) (possibly looks to trap beforehand).

Fast Forward : Auction Breakdown

The Market Flushed Initial Balance lows threatening to retest prior day lows. This flush personally was suspicious. I’ve previously named them “Pulled Bid Liquidations” : the TLDR : Bear Trap. Market Makers like to trick candle players as on the surface it looks like a sharp move lower and a breakdown from Open.

Yes this of course is a possibility, but to an orderflow trader, you understand the commitment that was previously made. This reasoning + combined with the structure previously mentioned leads to my decision to long, expecting an immediate reaction.

The Retest and Fail + Activity into Fresh lows surely tricked many sellers.

Unfortunately for them, Todays’ MM presses higher.

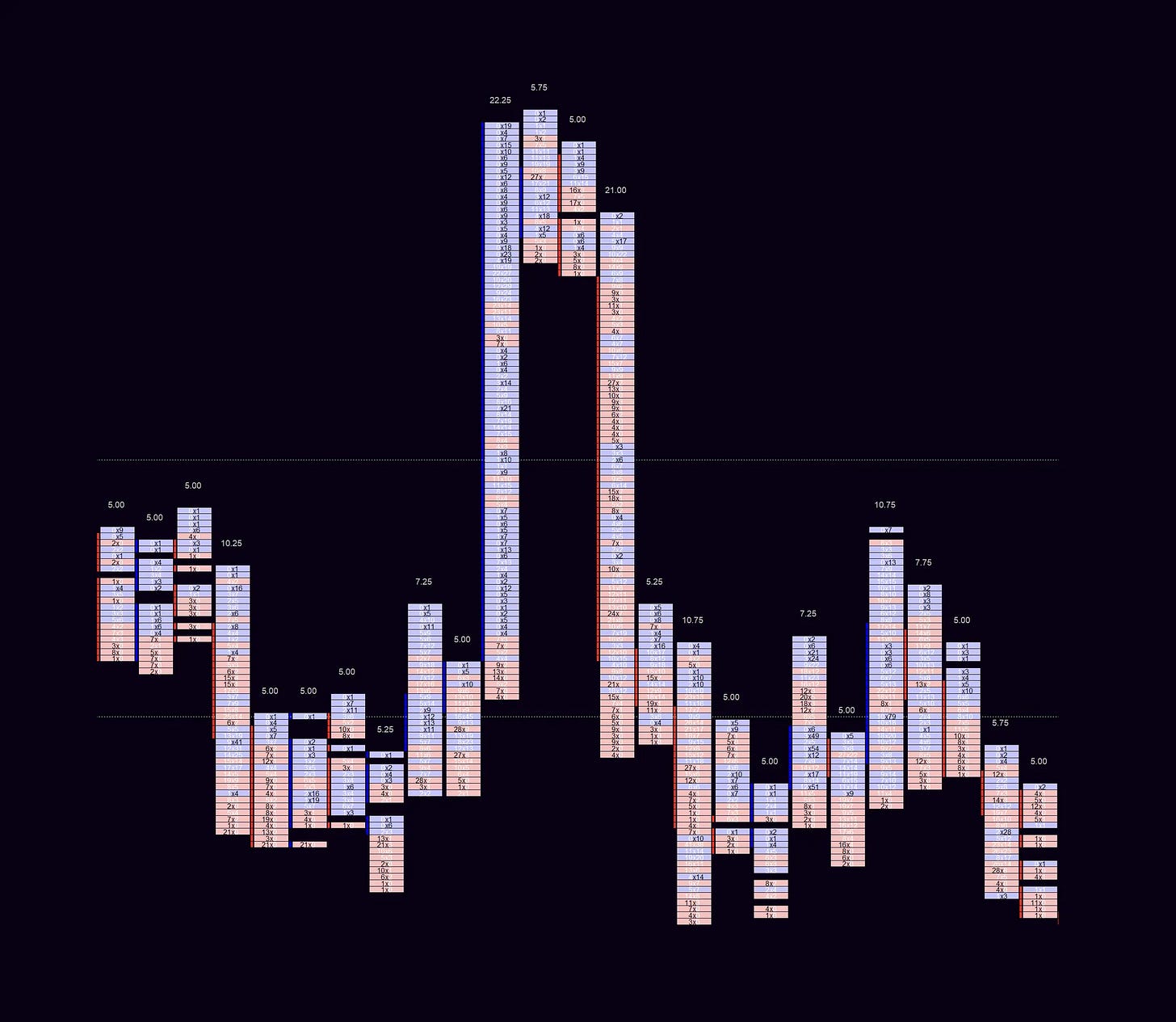

Overlaying my Fills with 2d Candlechart. It seems like the Pulse I am chasing is (currently) the correct one. I see an Initiative move to the downside, met by an Initiative move to the upside. This session is a continuation of the upside, protecting the positioning established lower. If the market can’t make a new low, it wants to make a new high.

Now you’re all caught up to my current sequence : Plan Below (Subscribe)

10/24 RTH+